reit dividend tax rate

In general the 20 percent maximum. Are REIT dividends subject to the maximum tax rate.

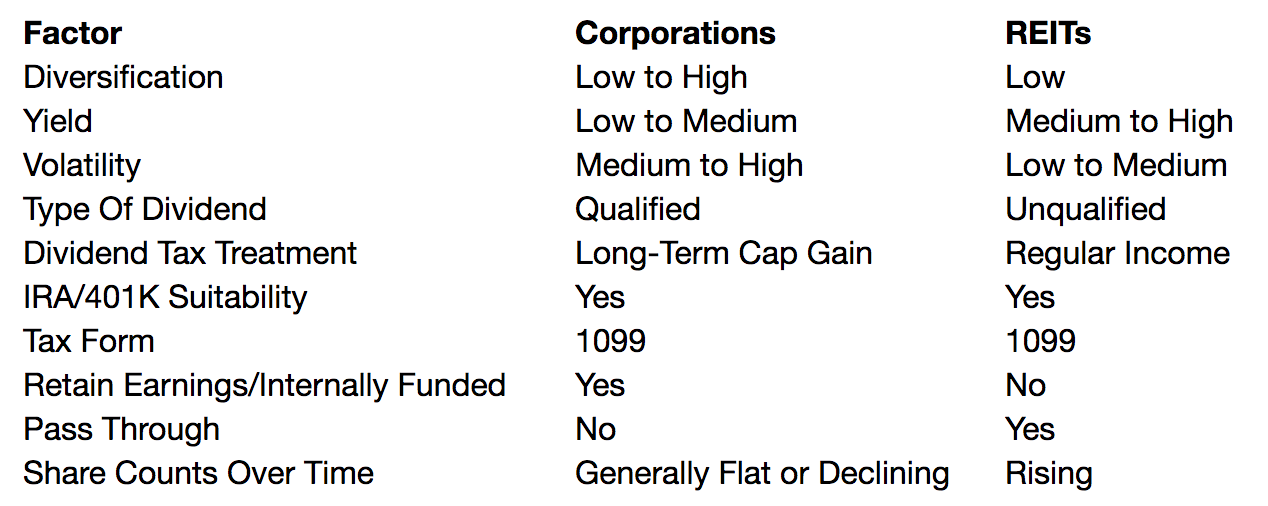

Sec 199a And Subchapter M Rics Vs Reits

Ad Direxion Daily Real Estate Bull Bear 3X ETF.

. Ordinary Income- Ordinary income of REITs is generated through rents and debt service and distributed to shareholders as dividends. Challenge the Old Buy Hold. REIT investors who receive these dividends are taxed.

By law and IRS regulation REITs must pay out 90 or more of their taxable profits to shareholders in the form of dividends. According to regulations at least 90 of profits from a REITs property rental business has to be distributed as PID dividends which are not subjected to corporation tax. 15 Withheld Foreign Tax Credit can be claimed.

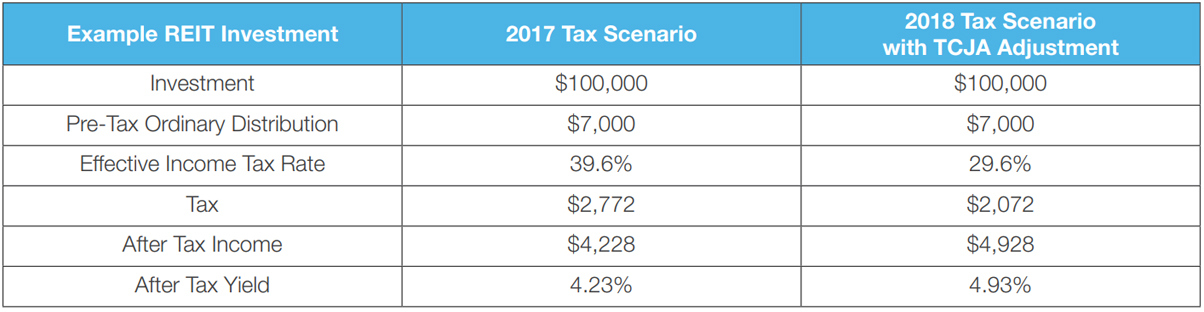

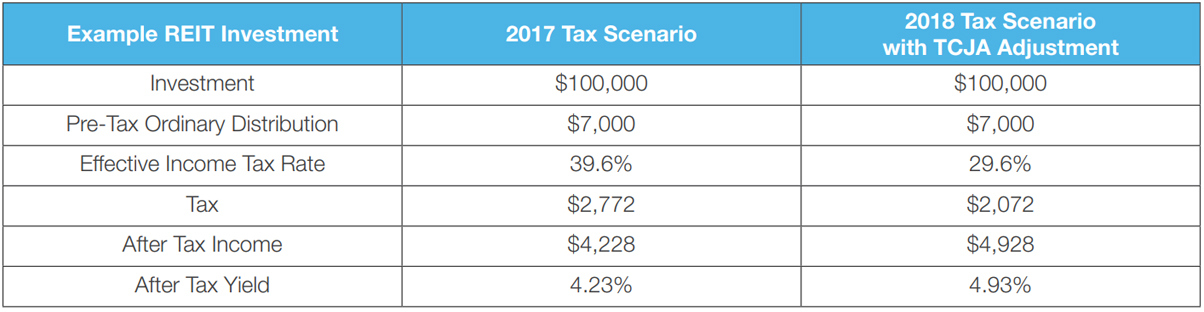

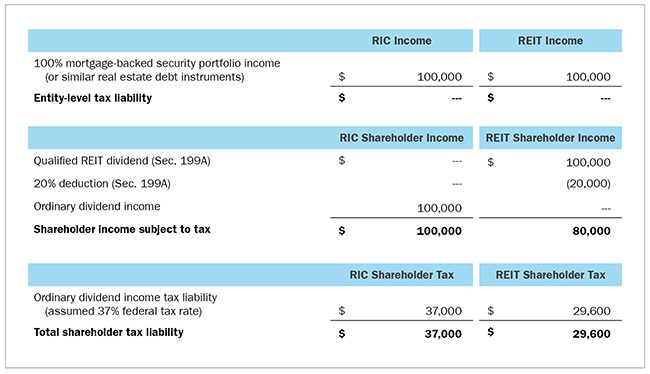

Ad Direct access to a range of real estate investments including funds and our new REIT. 65 tax rate if shareholder owns more than 50 of the REITs shares for the 12 months before the dividend is declared. The Tax Cuts and Jobs Act TCJA provides a 20 deduction for pass-through business.

Nareit has updated its tax treaty chart through Jan. In fact the REIT raised its quarterly dividend payout by 25 cents or 167 year-over-year to 175 for the fiscal third quarter of 2022 payable on September 30. REITs earn income by leasing space and obtaining rent from its real estate.

The trust deducts tax TDS. Withholding tax rates on ordinary REIT dividends to non-US. Any money distributed by an InvIT or REIT like interest dividend or rental income for REITs is taxable at the slab rate applicable to the unitholder.

Dividends from real estate investment trusts or REITs are considered taxable income in the eyes of the IRS but theres much more to the story than that. 710 if shareholder owns at least 10 of the REITs voting stock. We have top picks to help you weather the storm.

C-REIT from CrowdStreet reinvents the REIT for private real estate investors. 5 tax rate if the corporate shareholder owns at least 10 of the. 7 rows Most REIT distributions are considered non-qualified dividends which means that they do not.

There is no cap on the deduction no wage restriction and itemized deductions are not required to receive this benefit. 5 tax rate if shareholder owns more than 50 of the REITs shares for the 12 months before the dividend is declared. The portion of a REIT dividend classified as income may be eligible for preferential tax treatment.

REITs are required to. The income they generate is then paid out to its shareholders in the form of dividends. REITs voting stock and in the case of REIT dividends paid to a c orp or ati n esid tin C yprus r Eg pt m h5 f REITs gross.

PID dividends are normally paid after deduction of withholding tax at the basic rate of income tax 20 which the REIT pays to HMRC on behalf of the shareholder. Ordinary income is taxed to a maximum tax rate of 396 plus 38 surtax based on the taxpayers income tax rate. Does the down market have you down.

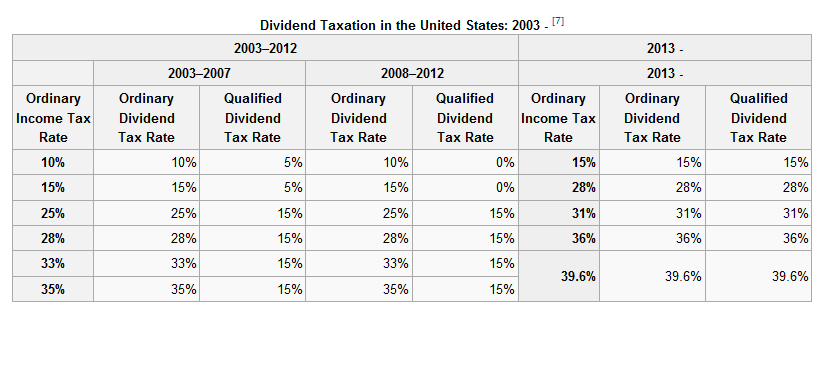

REIT dividends are taxed as one of three types of return. 10 if shareholder owns at least 10 of the REITs voting stock. The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate.

If the property was owned for a year or more though it is considered a long-term gain and is taxed at either 0 15 or 20. Second your REIT can also provide you with. Because they can be allocated to ordinary income capital gains and return of capital REIT dividends can be taxed at various rates.

Ad 5 Reasons Why We Think You Should Get Into Real Estate Investment Trusts. 1 2020 to accurately reflect US. This provision qualified business income effectively lowers.

15 Withheld No Foreign Tax Credit. Income tax rate applies.

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

A Short Lesson On Reit Taxation

The Reit Stuff How Reit Etfs Can Send Your Dividends Through The Roof

How Dividend Reinvestments Are Taxed

Understanding The Reit Taxation Rules Novel Investor

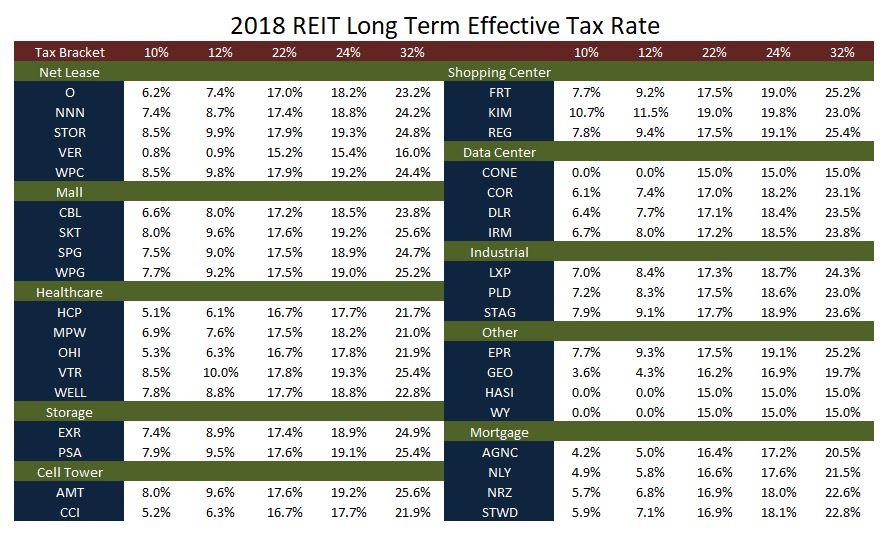

How Tax Efficient Are Your Reits Seeking Alpha

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com

How Dividend Reinvestments Are Taxed

U S Dividends And The Capital Gains Tax Rate Since 1961 Seeking Alpha

Guide To Reits Reit Tax Advantages More

Your Dividend Tax Rates 3 Examples Calculate Tax On Your Qualified Dividends Like A Pro Youtube

Reit Taxation A Canadian Guide

1940 Act Reits Vs Rics The Qualified Business Income Deduction Cohen Company

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Guide To Reits Reit Tax Advantages More